Three tactics for stealing SaaS users

Making the switch simple: Lessons from SavvyCal, Kit, and Coda

👋 Hey, I’m George Chasiotis. Welcome to GrowthWaves, your weekly dose of B2B growth insights—featuring powerful case studies, emerging trends, and unconventional strategies you won’t find anywhere else.

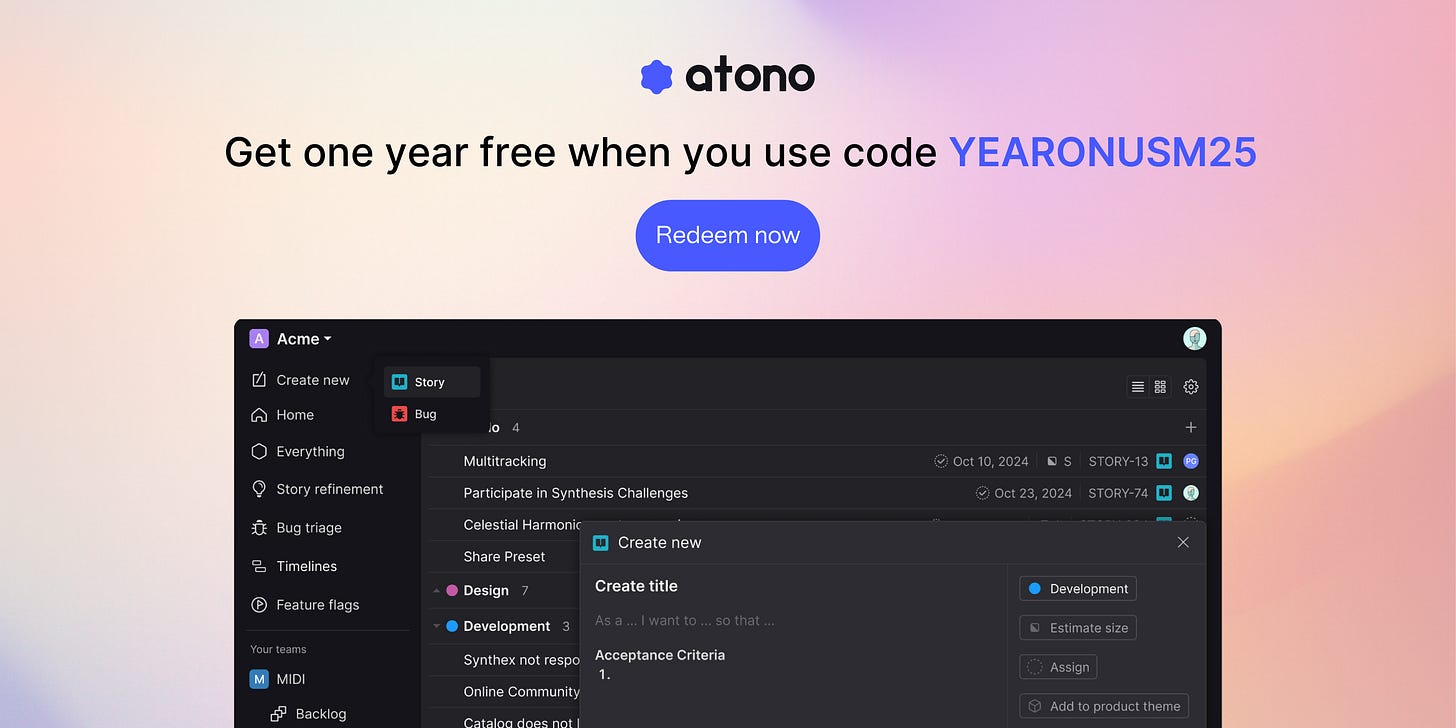

This GrowthWaves note is brought to you by Atono.

To the technical folks of my newsletter, this one is for you:

Stay focused: A clean and minimalist UI that helps your team stay on task—without clutter or distractions.

Stories at the center: Stories are first-class objects that highlight customer value, set clear goals, and keep your team aligned.

Less juggling, more building: Bringing roadmapping, story writing, feature flagging, bug reporting, and usage tracking together in one place.

Build better software together with Atono.

You can try Atono for free with a monthly plan for up to 25 users using the code YEARONUSM25 at checkout.

Even though other companies can use the tactics presented below, the examples I’m using are from SaaS companies.

One of the things that happens in SaaS companies is churn; you want to measure it and certainly prevent it or at least improve it.

One of the reasons why churn happens is because a buyer has found a better alternative.

I’m not here to talk about why that happens.

I’m here to share three tactics you can use to make the decision easier for people who’re looking for another vendor.

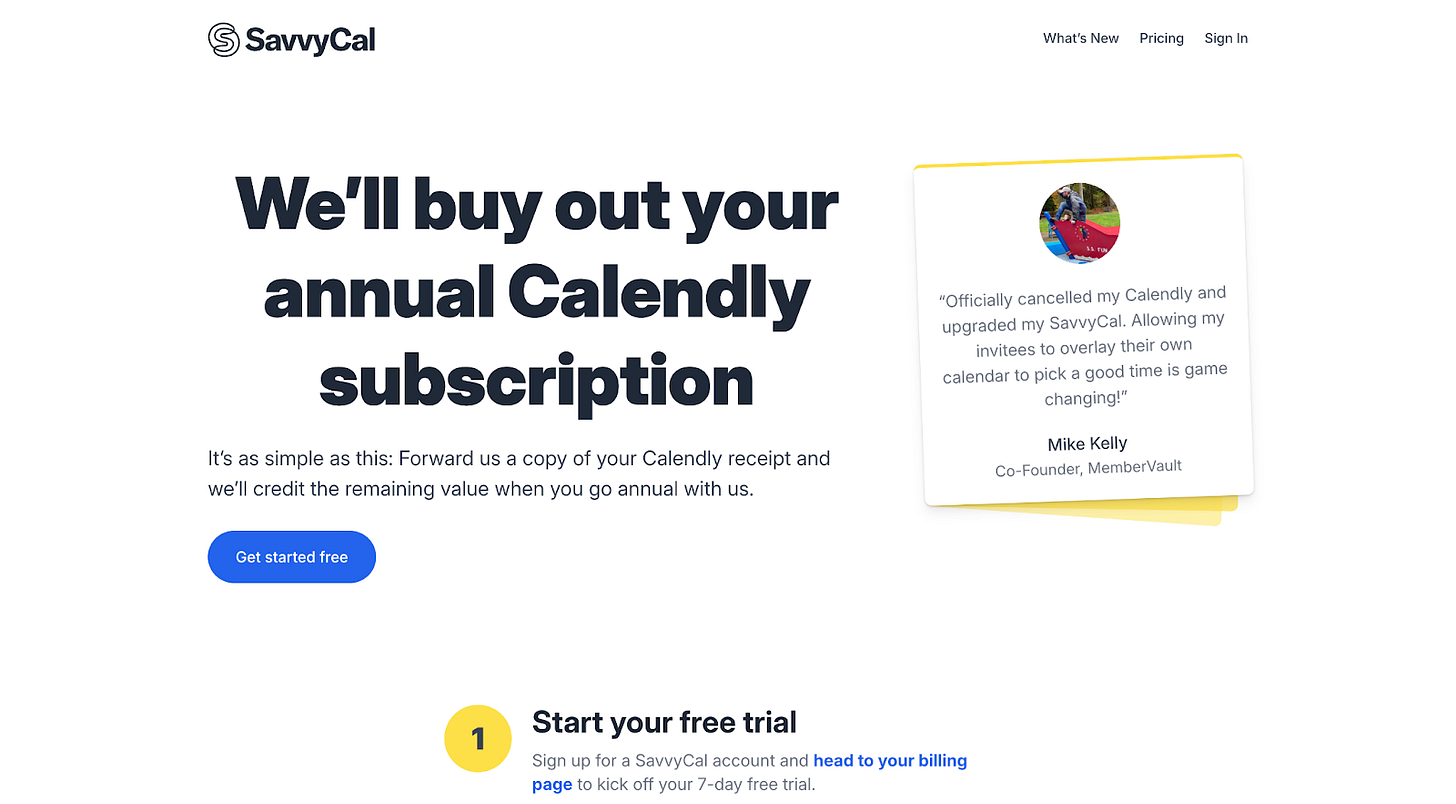

Tactic #1: SavvyCal's remaining contract value buyout

Have you heard of SavvyCall? It’s an alternative to Calendly, competing against many other tools in the meeting scheduling category, which is as Red Ocean as it can get (which is a good thing, IMO).

In a category like this, there are a few things that are true:

Competition is very intense, and most marketing channels are already saturated

Buyers are aware of the most prominent players in the category and most likely already use a tool

Products are mature, and most product features are considered table stakes

That is enough to steer most people away from the category. I see it as an opportunity because as the category leader and its challengers become bigger, they make mistakes like changing their pricing or building for the enterprise (which can be totally justified on their end, by the way), which leads to churn.

And guess where all these buyers will go. To someone willing to buy out the remaining contract value from the category’s leader. In this example, that’s Calendly.

The thing is, SavvyCal knows that Calendly is the category leader. They also must have heard prospective buyers' objections, such as “I’m locked in this annual contract,” and decided to take action.

What can you say when someone offers to buy out the remaining value of your contract? It makes switching risk-free from a financial standpoint.

Well done, SavvyCal.

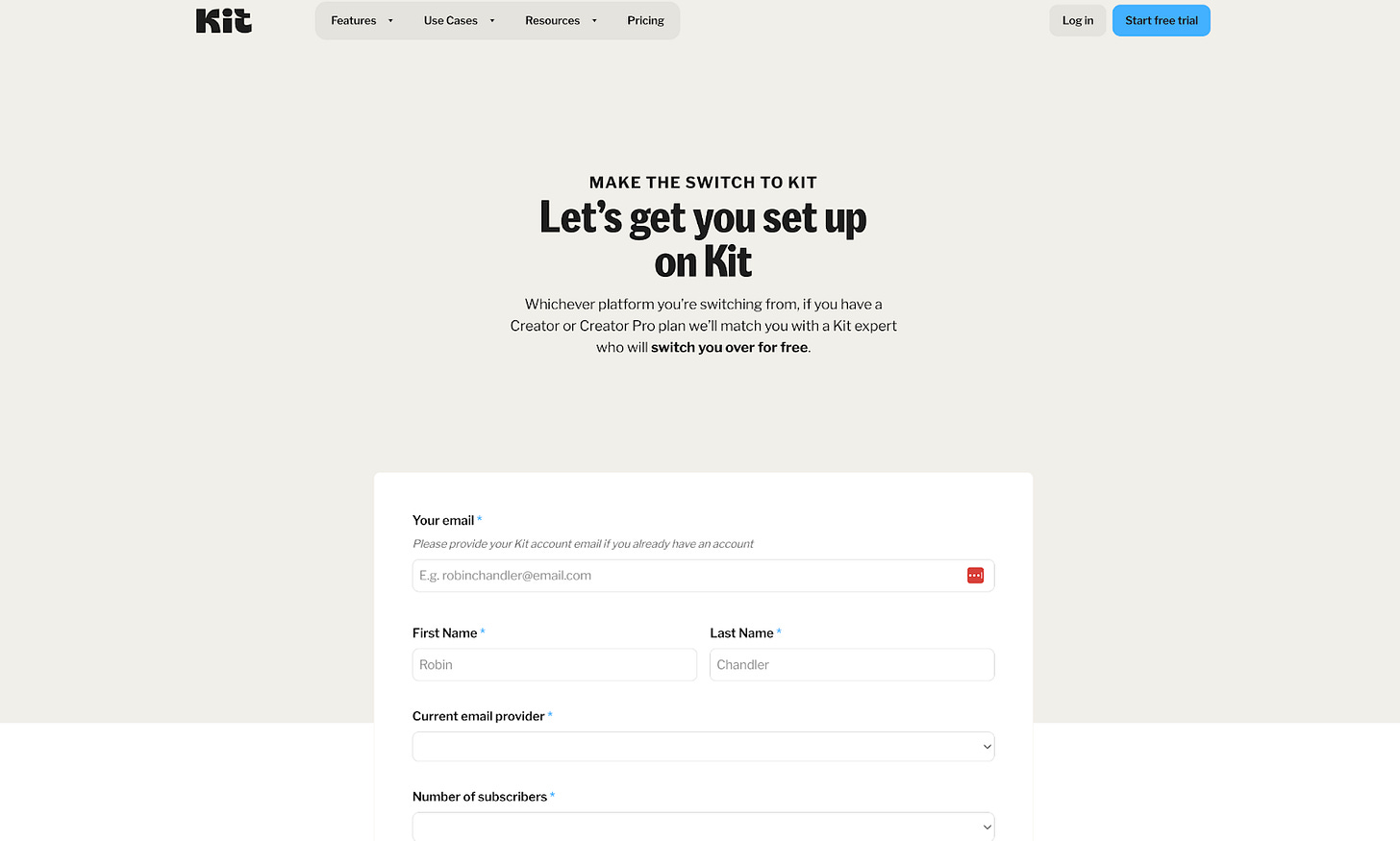

Tactic #2: Kit's Migration Service

In some instances, switching isn’t as easy. The reason? The product may safeguard one of your business assets. An example is the email marketing category.

The more you build your email list, the more attached you are to the tool you’re using, and the more difficult it becomes to switch. That’s unless you offer a migration service, precisely what Kit (formerly ConvertKit) does.

To be clear, I haven’t used Kit’s migration service, and I don’t know how good and reliable it is. I’m evaluating it only from the standpoint of a prospective buyer who is considering switching.

Here, too, we’re in a mature category with established players. This means many buyers switching (or thinking about switching) to Kit already use an email marketing and automation tool and aren’t happy with it. This means that they (the buyers) already have an email list and other automation in place.

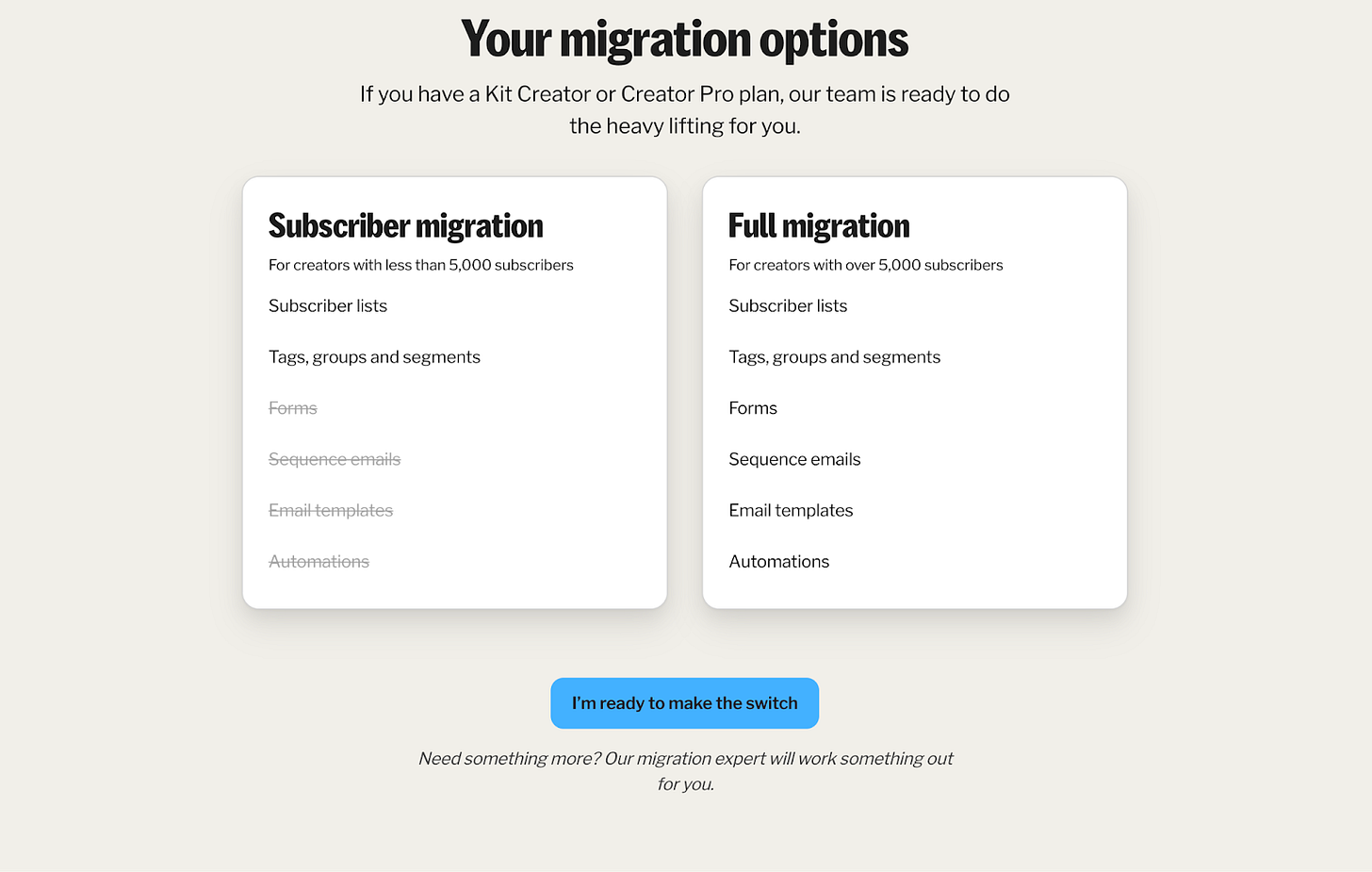

Kit currently offers two options:

The main differences between the two options are the number of subscribers and whether this is a full-scale migration (with templates, forms, sequences, etc.) or a simple subscriber list migration.

I’m guessing that Kit knows these two factors are essential in determining the potential value of a prospective buyer relative to the cost of implementing the migration.

Well done, Kit.

Tactic #3: Coda's stack replacement calculator

The third tactic comes from Coda, which Grammarly recently acquired. Because of its diverse capabilities, Coda competes against many tools in the broadly defined productivity tools category.

In a space like this, buyers aren’t only aware of the category leaders, but they most likely use several tools to do their job. Of course, this leads to “tool sprawl,” and in paying for tools you don’t get the most of.

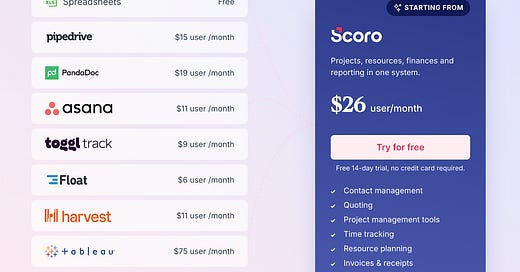

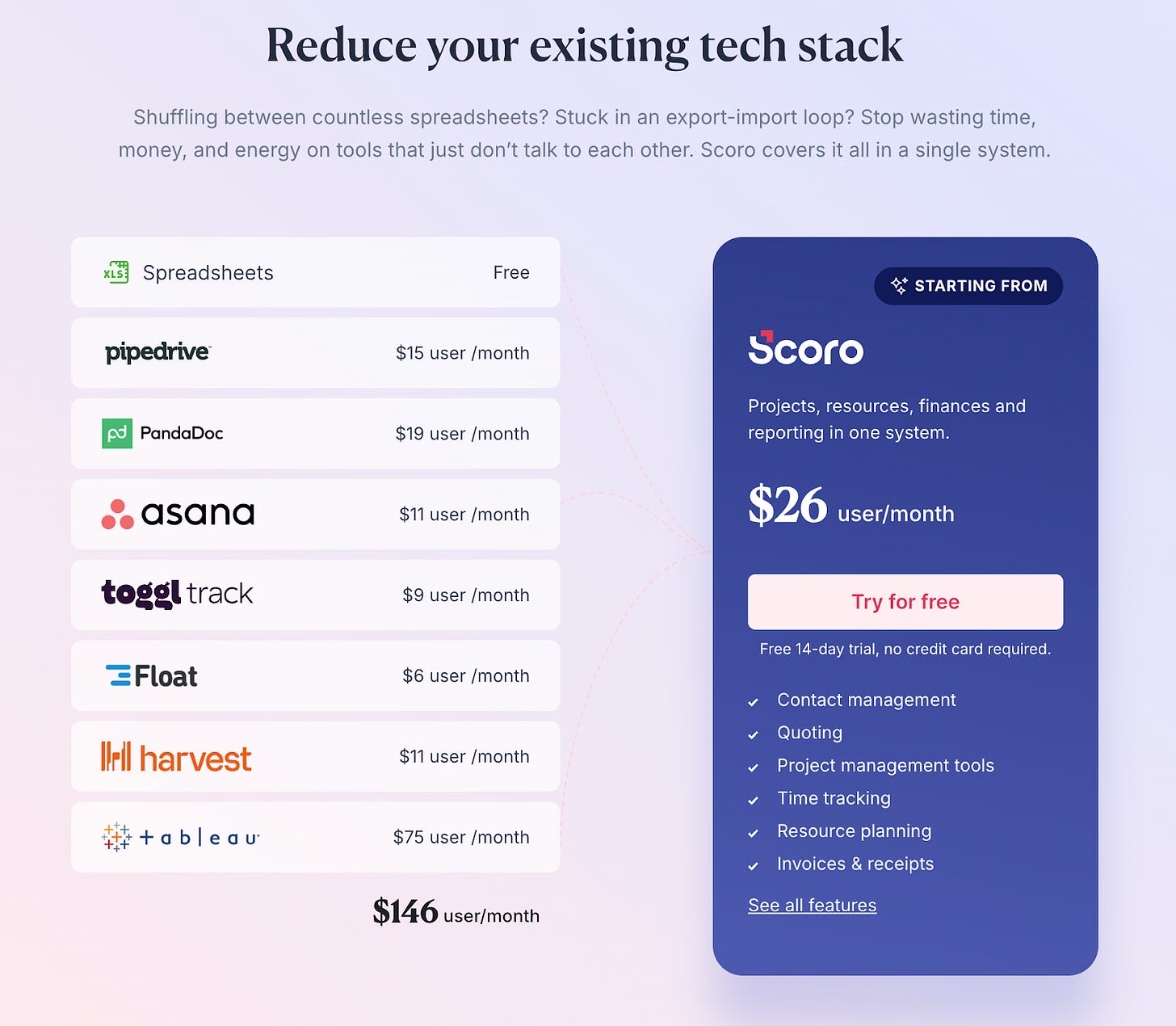

You have the stack replacement tables, which are good as table stakes. (The example below is from Scoro.)

Coda took things to a whole new level (I haven’t prepared for this; I’m using the calculator for the first time for the purposes of this note):

Now, I don’t expect the calculator to be 100% accurate. But if I were considering consolidating productivity tools because I was concerned about utilization and costs, Coda’s calculator would be a great starting point.

Well done, Coda.

Final thoughts

What we’ve seen in this piece is three tactics for removing the objection of your prospective buyers and making the switching process easier:

Buy out the remaining contract value;

Help them migrate to your service;

Help them calculate the savings.

These three tactics shouldn’t be used in isolation. What I mean is that you shouldn’t expect just to use one or even two of them and make an impact on your pipeline or revenue goals.

They should be part of a conscious and strategic effort to make switching over to your solution more seamless and efficient.

See you next week!